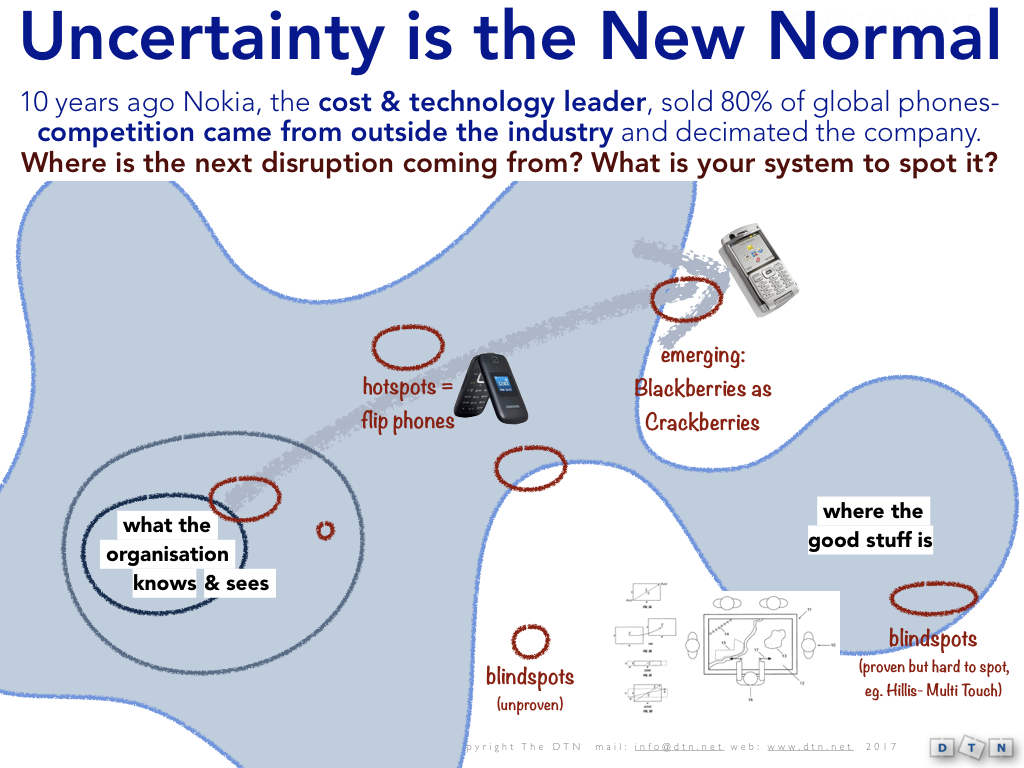

Uncertainty has become the new normal. A bit over a decade ago Nokia shipped 80% of the telephones in the world, could manufacture at half the cost of its competition and yet competition came from outside the industry, was swift and brutal. Recently a Chief Economist responsible for well in excess of half a trillion dollars of investment, related his dilemma. “I know that 40% of the S&P companies will be gone in the next 10 or so years. Hence it matters less to us the short term performance of companies. What really matters is that whether they will be around at all in 10 years time. On that we want to put our money.” Whilst this might not be an appropriate investment philosophy for everyone, unless organisations have systems to see these shifts, they will become victims of it.

In an interconnected world, being the biggest or the cheapest is no longer a guarantee for sustained success. We spend our time focused on the known, but fail to anticipate the unexpected. Off-radar risks are the most dangerous, as the organisation is wholly unprepared for disruptive change, rapid technologic shifts, or the slow changes that build up to tipping points.

And yet it is inhuman to amass all the off radar/ long tail trends in the world. The world is complex not complicated. Uncertainty is interconnected, uncertainty is off-radar and uncertainty will eat your breakfast, lunch and dinner if you do not obsess over it. It is in the combination of human and machine intelligence that we address this problem. We call it IA- Intelligence Augmented.

Big data combined with advanced natural language processing allow us to map entire domains of knowledge. With these new maps we can see these hard to find off-radar edges. Early Learning Systems combine models of the future with the big data analytics to algorithmically gain edge insights into very large corpora of unstructured data.

Survival demands interacting with, not ignoring the environment. It demands a 21st Century process to recognise and act on these edge insights. In the words of Arie de Geus, former head of Shell Scenarios, it requires a “focus on learning faster”.

By producing Global Risk Radar Reports we provide a simple, visual AI generated overview of risks that face the asset allocation community. We enable pension funds to anticipate risk/opportunities rather than be victims of these changes.